Garret Jones and I have had an exchange of remarks on twitter:

In this exchange, Garret Jones makes three points:

Hereditarians/pro-IQ types are not willing to admit to the fact that the private returns to IQ are “low”. (probably false)

A substantial fraction of the relationship between national IQ and GDP per capita is due to externalities, not private differences. (true)

Correlation matters less than effect size measured in real units. (not relevant)

Here are my responses to both those claims:

Claim 1: Hereditarians/pro-IQ types are not willing to admit to the fact that the private returns to IQ are “low”.

Garret assumes that the private returns to IQ are low - which is a statement that can be verified. Given that IQ is a relative metric, the difference between the correlation and the effect size is unimportant, but I have posted both for the purposes of transparency.

As of current date, the largest meta-analysis suggests that the correlation between IQ and income is .22:

To avoid the trap of the man of many studies, I think it’s best to avoid low quality datasets and instead stick to the best ones. On my computer, I currently have both NLSYs downloaded as well as the project talent dataset, so that’s what I will be sticking with. All of these datasets have very extensive cognitive testing data, making unreliability a null concern, and most of the individuals were tested after they turned 12.

These are the effect sizes that I found:

NLSY97: r = .28 logged, 1.7% increase in earnings for every one unit increase in IQ.

NLSY79: r = .33 logged, 2.07% increase earnings for every one unit increase in IQ.

Project Talent: r = .16 logged, 1.007% increase earnings for every one unit increase in IQ.

The smallest effect size from here (project talent) both below the meta-analysis and above Jones’ claim of a “1% return”, so I think it’s safe to say that the return of IQ on income is reasonably higher than 1%, possibly as high as 2%.

As for the heterogeniety, all of these datasets are very large (n = 4000+), so sampling error is clearly not the problem. The IQ tests are not the problem, as more than 10 tests were used in each case. There could be a time trend at play here, though this was not found in the original meta-analysis by Strenze, so I doubt this is the issue either. It is possible that, for unclear reasons, some datasets measured income better than other ones. To test that hypothesis, I also calculated the correlation between parental SES and IQ/earnings. These were the results:

NLSY97: r(IQ, pSES) = .45, r(logearnings, pSES) = .19

NLSY79: r(IQ, pSES) = .46, r(logearnings, pSES) = .22

Project Talent: r(IQ, pSES) = .45, r(logearnings, pSES) = .13

The relationship between parental SES and child IQ is consistently the same in each dataset, but the relationship between parental SES and the child’s earnings between datasets almost perfectly tracks the relationship between the child’s IQ and their earnings. This means that whatever is responsible for the heterogeniety in the relationship between IQ and earnings is also probably responsible for the heterogeniety in the relationship between earnings and parental SES, though it’s difficult to tell with just n=3.

On average, one unit increase in IQ is associated with a 1.59% increase in income. This means that a standard deviation increase in IQ is associated with a 27% change in income - I wouldn’t consider this a “low” return, though I suppose to each their own interpretation of an effect size.

As for whether “team IQ” is scared about the truth about IQ and income getting out, this doesn’t seem to be the case. George Francis made the same argument about public vs private returns in a debate about immigration vs Hanania, and got quite a bit of support. I have also written against the idea that IQ is a very large factor life outcomes or consistency/quality of ideas, with little pushback. It’s possible that he interacts with different IQ realists or hereditarians, though it’s hard to tell.

Claim 2: A substantial fraction of the relationship between national IQ and GDP per capita is due to externalities, not private differences. (true)

This is a very easy claim to verify. Simply comparing the effect size between nations and between nations will do. On my computer I have a composite measurement of national IQ based on the Lynn and Vannhanen 2012 estimates, Becker’s psychometric estimates, Becker’s psychometric/scholastic estimates, and harmonized test scores. This national IQ metric correlates with GDP per capita in 2013 (IMF estimate) at .63 when unlogged and .75 when logged. Every unit increase in national IQ was associated with an 8.4% increase in GDP per capita, so about 19% of the national differences are due to private differences.

In his paper, he claims that private differences account for 16% of the national differences, which is consistent with my data.

Claim 3: Correlation matters less than effect size measured in real units.

Looking back at the effect sizes I calculated, the correlations and % increases seem to communicate the same information, so the use of one over the other is irrelevant. If it were up to me, I would use the absolute increase for every one point of IQ; it’s not like your employer pays you in logged dollars. I am aware that the logged distribution satisifies normality better, but the difference is fairly marginal, visually speaking.

Appendix

NLSY97 methodology:

age controlled for using splines

people in college are removed

people making no money are removed

parental SES measured using assets + education + income composite

general factor score computed for IQ, then normed to the nonblack/nonhispanic mean/SD

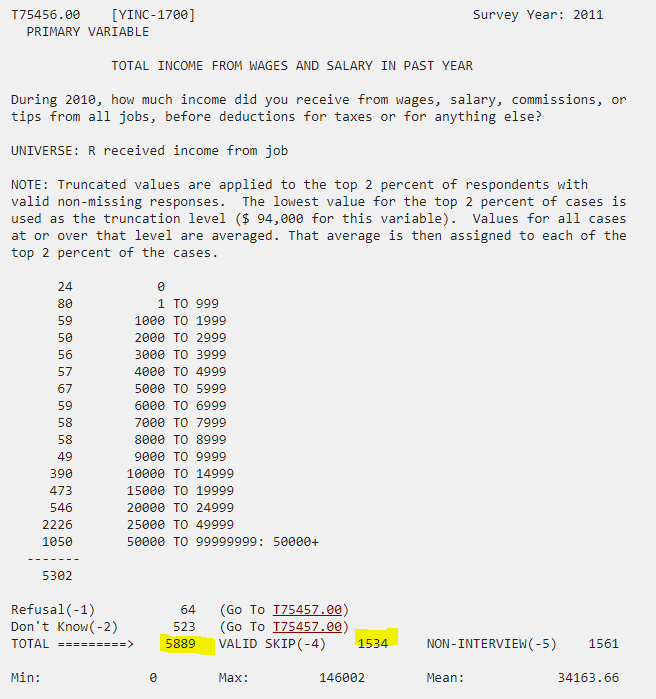

income taken from 2010 (T7545600), when the respondents were 26-30

NLSY79 methodology:

people in college are removed

general factor score computed for IQ, then normed to the nonblack/nonhispanic mean/SD

age controlled for with splines

parental SES measured using parental education + income (no assets, unfortunately)

people making no money are removed

income taken from 1989, when the respondents were about 25-33

PROJECT TALENT methodology:

Estimated annual earnings used (Y11_O221)

general factor score computed for IQ from several subfactors (same method used for the college major IQs)

parental SES measured using the provided variable (socioeconomic index)

people making no money are removed

income sampled in the 11 year followup, which is 11 years after the individual graduated from high school

Between countries:

NIQ is QNW, QNW.SAS, L.V12, harmonzed test scores composite

harmonized test scores normed to IQ to avoid dataset bias

GDP per capita was averaged from the IMF and world bank estimates in 2013

For 2000, just the world bank estimate was used

No geographical imputations were made at all.

The best answer to Garrett would have been to send him this link https://humanvarieties.org/2016/01/31/iq-and-permanent-income-sizing-up-the-iq-paradox/

And see just how he reacts...

And additionally sending him Marks (2022) paper along with this line: "a one standard deviation difference in ability is associated with a about a 40% increase in average personal income for ages 25 to 39." From Cognitive ability has powerful, widespread and robust effects on social stratification: Evidence from the 1979 and 1997 US National Longitudinal Surveys of Youth

A few comments otherwise. Income has its highest predictive power when measured at around age 40 or close to 40. Especially averaged over multiple years near age 40. Averaging attenuates measurement error. Dalliard also made this argument to say that Garrett underestimated the effect of individual's IQ. Another advantage is that when averaged over a large period of time, e.g., income averaged for age 35-44, is that if you want to remove zeros, the interpretation is different and more meaningful. A zero when income is a single-year measure of income can simply mean the individual is still seeking a job and might be earning an income next year, despite not earning any income in this current year. But a zero when income is averaged over so many years implies this person is likely never going to seek a job, and this means removing this zero has less chance of removing a person who is seeking a job.

Aren't there personal cases that low national IQ is beneficial? For example, let's compare 120 IQ person in Nigeria with 120 IQ person in Japan. The first is at the end of the demand curve. He is not under the pressure of competitive conditions like the latter. I think the income-IQ correlation is higher in low IQ countries.